The Australian Securities and Investments Commission (ASIC) has advised locally operated and authorized companies to prepare for the impending introduction of a mandatory climate disclosure regime.

In a keynote speech at the Deakin Law School International Sustainability Reporting Forum, Joe Longo, the Chairman of ASIC, emphasized that entities should begin putting systems, processes and governance practices in place to meet the new climate reporting requirements.

ASIC Urges Firms to Prepare for Mandatory Climate Disclosure Regime

Over 6,000 entities, including those holding Australian Financial Services (AFS) licenses, will be required to report under the new mandatory disclosure framework within the next few years. The regime will be implemented using a phased approach starting from the 1 July 2024.

“As I’ve said before, the growing interest in environmental, social, and governance(ESG) issues is driving the biggest changes to financial reporting and disclosure standards in a generation,” commented Longo.

ASIC 's Chairman acknowledged industry concerns about the potential complexity of the new reporting requirements. He assured that ASIC will take a pragmatic approach to supervision and enforcement as with any new regulatory regime. The regulator plans to develop and issue guidance to help entities meet their new obligations.

“This is a transformational issue for global markets, and we need to be ready to meet that change at every step of its development. To do that, we must maintain high standards of governance and disclosure,” Longo added.

ASIC will also collaborate with the government and other Council of Financial Regulators agencies on supporting implementation, including initiatives to assist entities in meeting the new requirements, such as addressing data challenges.

ASIC mentioned some of the future climate action in its 4-year plan published in 2022. Recently, the regulator won a historic greenwashing case against Vanguard, which admitted to misleading investors about ESG screens in its billion-dollar fund.

Benefits of Climate Disclosure for Entities

While there will be costs for entities to report, Longo highlighted that they will also benefit from greater visibility of physical and transitional climate risks and opportunities across their value chains and the entire economy. This will support companies, including AFS licensees, to manage their climate-related risks and opportunities over the short, medium and long term.

ASIC's Chairman also emphasized the importance of considering both the benefits and challenges of the reforms. Compliance with the new requirements is a legal obligation and makes good business sense in light of Australia's commitment to net zero emissions by 2050 and the Paris Agreement goals.

“The Australian Government has legislated Australia's commitment to be net zero by 2050 and to reduce emissions by 43% below 2005 levels by 2030,” Longo added.

Preparing for the New Regime

Longo urged entities not to wait until the legislation passes to start preparing. ASIC considered that those already reporting voluntarily under the Task Force on Climate-Related Financial Disclosures (TCFD) framework will be well-placed to meet the new mandatory requirements based on the TCFD's four pillars.

The regulator has encouraged licensees to develop the necessary organizational and governance structures to support future reporting requirements. This includes engaging with the International Sustainability Standards Board's climate-related disclosure standards to assess capabilities and data requirements.

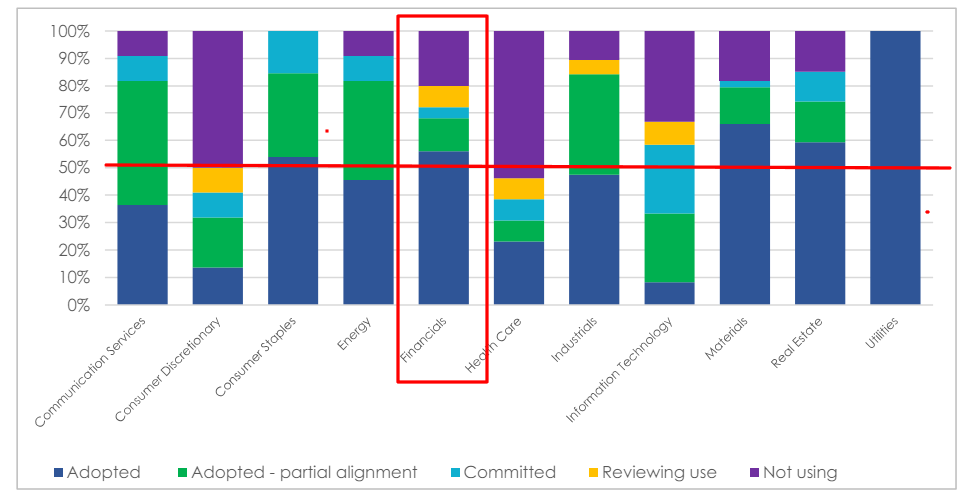

According to the report by ASIC in August 2023 called “Promises, Pathways & Performance” regarding climate change disclosure in Australian companies, the finance sector was already well positioned for the changes in 2022.

Most of the surveyed companies have implemented or are in the process of implementing the TCFD framework.

In addition to climate, ASIC is monitoring developments around other sustainability topics like nature and biodiversity. The regulator advised entities to ensure any systems and processes adopted for climate disclosures are sufficiently agile to incorporate additional sustainability topics in the future.

"While it’s too early to discuss enforcement strategy, that should not be taken to mean it’s too early to prepare,” ASIC's Chairman explained.

Implications for AFS Licensees

Introducing a mandatory climate disclosure regime has significant implications for AFS licensees. As ASIC-regulated entities, they will need to comply with the new reporting requirements in accordance with the phased implementation timeline based on their size and greenhouse gas emissions.

AFS licensees should heed ASIC's advice to start preparing early by:

- assessing their readiness to report under the TCFD framework,

- putting in place systems, processes and governance practices to meet the new obligations ,

- engaging with the climate disclosure standards being developed in Australia and internationally, and

- ensuring any systems implemented are flexible to accommodate future sustainability reporting requirements.

Proactive preparation will enable AFS licensees to meet their compliance obligations, avoid greenwashing, and realize the benefits of enhanced climate risk management and opportunity identification. As Longo concluded, entities "need to start preparing for the future, now."